Hello, dear colleagues!

There is not much time left until the end of the year, but we can assume that gold will be the main disappointment of investors in 2022. If no one expected rapid growth from the stock market amid rising interest rates, then gold has always acted as a lifeline, a safe haven for investors during periods of instability. However, having reached 2,070 in March, gold ends October with a decline, and although there is still time before the end of the year, we can already assume that gold will finish it on a minor note and even, perhaps, will be lower than now.

Some of the readers may object that I cannot say this, but what is good about technical analysis is a clear formalization of the rules. The movement will continue until we get the opposite, says its main postulate, and if we look at the gold chart, then we will see a decreasing trend in the daily timeframe, namely a series of consistently decreasing lows and highs (Fig.1).

Fig.1: Dynamics of the gold price on the daily timeframe

As you can see from the chart, the price of gold is now lower than it was a year ago. In October 2021, an ounce cost about $1,800, and now its price is approaching the level of $1,600 and, quite possibly, it will overcome it and go even lower. You will say, "How can I know that?". I do not know, I assume this possibility based on the rules of technical analysis.

Then the reader may have another question: "So, is it possible to sell gold now?". It is possible, but it is better to wait for more favorable prices for selling. The fact is that selling in support of the formed price at the level of $1,622 is not a very good solution. In fact, this level is the first target of the decline, which was formed by a correction to the level of $1,738, where the local high was formed. Once the price could not pass this level, and I do not know if it will be able to pass it now.

Among other things, before opening a position and calculating the profit, we need to set a place where we will fix the loss. Such a place right now is at $1,738. The same level is the place of the trend reversal. In other words, if the price of gold turns around, then if the value of $ 1,738 is exceeded, it will be possible to state that the downward trend of the daily half is over.

According to the chart, now the price is at around $1,637, therefore, when opening a position for selling, possible losses will amount to $100 per contract. Following the principle that the profit should always be at least twice as large as the loss, our sales goals should be located $200 lower, i.e. around the value of $1,450. If you are ready to open such a position, then I have nothing against it, if not, then I suggest you wait.

In fact, the scenario of a decline in gold to the level of $ 1,450 does not look as improbable as it may seem to someone. Such a scenario is quite possible in the event of a sharp drop in stock indices in the United States, which, by the way, everyone is waiting for now, but which, most likely, will not happen in any way. Let's consider such a scenario in the context of inter-market analysis.

Fig.2: Dynamics of the movement of the S&P 500 index on the daily timeframe

Over the past year, the index has declined from the January 2022 high, located at $4,818, to the current value of $3,678 (Fig. 2). As follows from the chart, the S&P 500 index is in a downward trend, where there are a number of consistently decreasing lows and highs, which suggests a further decline to the level of $3,000. At the same time, the decline in the index is gradual, which does not cause negative consequences in the markets. By negative consequences, I mean margin call, when investors are forced to close their positions in view of the need to make a margin. In total, the decline in the index was 23%, which in itself indicates the beginning of a bear market.

Actually, such a gradual decline in the stock market is atypical. Markets usually fall faster than they rise. That is why the position for selling is called "short", and the position for buying is called "long". From the point of view of dynamics, we can assume an acceleration of the downward trend, which means the occurrence of Margin call among many participants.

This forces traders to close positions throughout the market, including closing positions in gold. Later, when the need arises to invest again, they will start buying gold, because there is nothing else to buy, but at first gold can fall quite sharply in price, including to the level of $1,450 per troy ounce.

Once again, I would like to draw your attention to the fact that this is not a prediction of the future, this is the most likely scenario for the development of events, and the fall of the US stock market, if it happens, of course, can only accelerate the process.

Many of us are wondering: "Why is the price not rising at all with such inflation?". Everyone knows that gold is a refuge that is resorted to when fiat money depreciates. So why is it now declining in price? The question, of course, does not have an unambiguous answer, but I can comment on something about this.

First of all, you and I must understand that gold is a commodity, and like any commodity, its value is determined in US dollars. As you know, the dollar is growing quite strongly this year against a basket of foreign currencies, which leads to a decrease in the value, including gold.

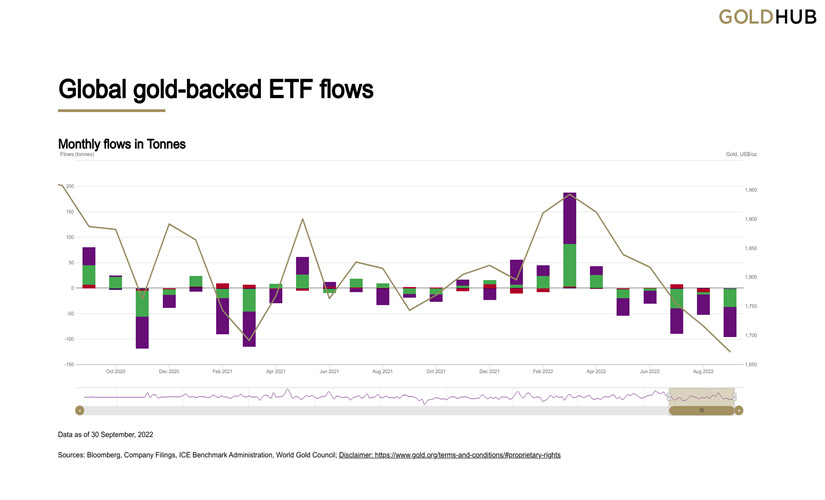

The price of the precious metal is determined on exchanges in the USA and London. The largest volume of gold trading occurs on the futures platforms of the Comex-CME exchange. In addition, exchange-traded funds investing in gold are common in the United States, and it is the behavior of investors in these funds that determines the price moment for gold. At the same time, since May of this year, investors in "paper gold" have been leaving this market (Fig.3), which negatively affects the price. Other sources of demand cannot compensate for the outflow of capital from gold exchange traded funds.

Fig.3: Outflow and inflow of gold to exchange-traded funds

Why investors leave exchange-traded funds is, of course, also an interesting question. Perhaps one of the reasons is that gold does not make it possible to generate cash flow, as, for example, bonds do, the yield of which this year has risen from the level of 1% to the level of 4% for 10-year US Treasury bonds.

American investors do not see the crisis escalating. So far, everything is fine with work in the US, with money too. No one cares about the debt level of 31 trillion. Yes, they began to pay a little more for gasoline. Yes, the mortgage has risen in price. Yes, inflation is breaking records, but who really cares when you can just earn money, and there are plenty of opportunities for this. Therefore, gold as an asset losing its price is not interesting, so they sell it slowly, preferring more profitable assets. However, this is only my opinion, and it may have nothing to do with the true causes of what is happening. Be careful and cautious, follow the rules of money management!