Trade Breakdown and Tips for Trading the British Pound

The test of the 1.2911 level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downward potential. For this reason, I did not sell the pound. The second test of this level came when the MACD was recovering from the oversold zone, which enabled scenario #2 for a buy and resulted in the pair rising toward the target level of 1.2940.

The absence of significant statistics from the UK once again worked in favor of the British pound, helping it rebound from the weekly lows. Investors seemed to interpret the lack of news as a positive sign, avoiding speculation about potential economic issues that might have been reflected in released data. This allowed the pound sterling to strengthen against the dollar.

The second half of the day promises to be equally eventful. The release of positive data on U.S. consumer confidence and new home sales will likely bring back demand for the dollar. A stronger U.S. dollar could weigh on the GBP/USD rate, pushing it lower. Investors are likely to view these reports as signs of a stable U.S. economy, making dollar-denominated assets more attractive. Conversely, if the actual figures fall short of expectations or show little change, the current upward trend in GBP/USD is likely to continue.

As for the intraday strategy, I will rely more on scenarios #1 and #2.

Buy Signal

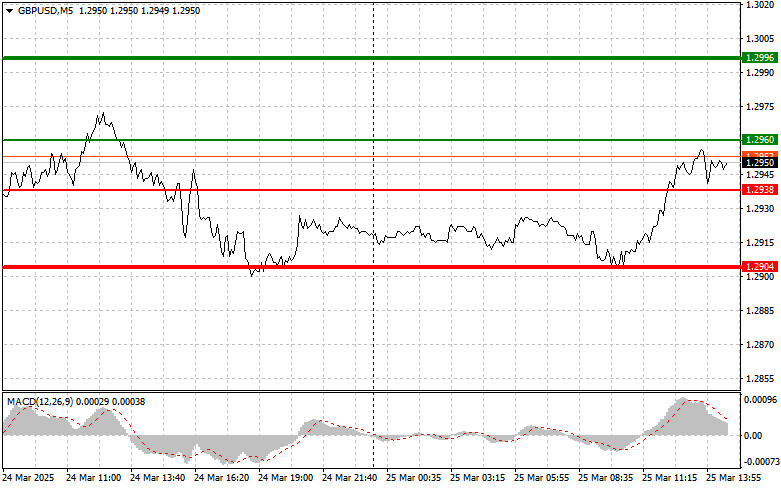

Scenario #1: I plan to buy the pound today after the entry point is reached around 1.2960 (green line on the chart) with the goal of rising to the level of 1.3000 (thicker green line on the chart). Around 1.3000, I plan to exit the long positions and initiate short positions in the opposite direction, aiming for a 30–35 point pullback from the level. A pound rally today can be expected within the current uptrend. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise from it.

Scenario #2: I also plan to buy the pound today in the event of two consecutive tests of the 1.2938 level when the MACD is in the oversold zone. This will limit the downward potential of the pair and lead to a reversal upward. A rise to the opposite levels of 1.2960 and 1.3000 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound today after the 1.2938 level is broken (red line on the chart), which should trigger a quick drop in the pair. The key target for sellers will be the 1.2904 level, where I plan to exit shorts and immediately open long positions in the opposite direction (expecting a 20–25 point rebound). Sellers will be more active if strong U.S. data is released. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to fall from it.

Scenario #2: I also plan to sell the pound today in the event of two consecutive tests of the 1.2960 level while the MACD is in the overbought zone. This will limit the pair's upward potential and lead to a downward reversal. A drop to the opposite levels of 1.2938 and 1.2904 can be expected.

Chart Guide:

- Thin green line – entry price for buying the trading instrument

- Thick green line – estimated price where Take Profit can be placed or profits can be manually locked in, as further growth above this level is unlikely

- Thin red line – entry price for selling the trading instrument

- Thick red line – estimated price where Take Profit can be placed or profits can be manually locked in, as further decline below this level is unlikely

- MACD indicator: It is crucial to follow overbought and oversold zones when entering the market

Important: Beginner traders in the Forex market must be very cautious when deciding to enter a trade. It's best to stay out of the market before the release of important fundamental reports to avoid getting caught in sharp price swings. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you could quickly lose your entire deposit, especially if you ignore money management and trade with large volumes.

And remember: for successful trading, you need a clear trading plan—like the one presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.