EUR/USD 5-Minute Analysis

The EUR/USD currency pair traded lower on Tuesday. Once again, volatility was far from low, which might suggest the presence of significant events or news during the day. However, there were none. Overall, Trump's rhetoric remains unchanged. For example, on Tuesday, the White House announced its readiness to impose tariffs on all solar panel imports from Asia. Meanwhile, they continue discussing trade negotiations with various countries, although no information is coming from those countries themselves. On the contrary, the European Union stated that they do not understand Trump's demands and that no progress is being made in the negotiations.

Thus, the market remains in chaos, if not outright panic. On Monday, the dollar plunged again, only to recover on Tuesday. There is practically no logic in the movements, and the market is ignoring many technical levels. The news flow continues to fuel market instability. The market is highly sensitive to any reports of a potential escalation in the global trade conflict and the ongoing Powell-Trump standoff.

Several trading signals were formed on Tuesday, but as previously mentioned, the market eagerly ignored all technical levels. As a result, many false signals emerged near the 1.1534 and 1.1474 levels. Once again, we emphasize that current price movements are extremely difficult to describe as logical or consistent. Regardless of what lies ahead for the U.S. economy, the dollar has dropped by 1100 pips against the euro in just two months—even though there has been little positive news from the Eurozone during that time.

COT Report

The latest COT report is dated April 15. The chart above clearly shows that the net position of non-commercial traders had long remained bullish. Bears barely managed to gain the upper hand but quickly lost it again. The bears' advantage has visibly diminished since Trump took office, and the dollar sharply declined. We cannot definitively say that the decline of the U.S. currency will continue, but COT reports reflect the sentiment of large players—which can change rapidly under the current circumstances.

We still see no fundamental factors justifying euro strength, but one significant factor is now driving dollar weakness. The pair may continue to correct for several more weeks or months, but a 16-year downtrend won't reverse so easily.

The red and blue lines have now crossed again, signaling a bullish trend in the market. During the latest reporting week, the "Non-commercial" group increased its long positions by 6,800 and reduced its short positions by 2,500, resulting in a net increase of 9,300 contracts.

EUR/USD 1-Hour Analysis

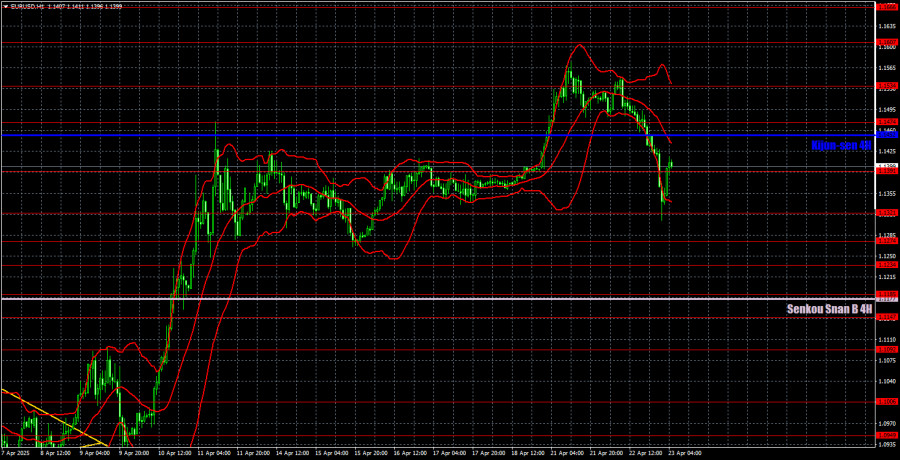

The EUR/USD pair continues its upward trend on the hourly timeframe, although there are no distinct trend lines or channels. On the daily timeframe, it is now official: the long-term downtrend has been broken. This would never have happened if Trump hadn't started a trade war. As a result, the fundamental backdrop has overridden the technical picture—a rare but not impossible event. Unfortunately, the upward trend could end just as sharply and unexpectedly if Trump stops imposing tariffs and moves toward de-escalation. There is very little logic or technical structure in the price action across any timeframe.

For April 23, we highlight the following levels for trading: 1.0823, 1.0886, 1.0949, 1.1006, 1.1092, 1.1147, 1.1185, 1.1234, 1.1274, 1.1321, 1.1391, 1.1474, 1.1607, 1.1666, as well as the Senkou Span B (1.1177) and Kijun-sen (1.1452) lines. Remember that Ichimoku indicator lines can shift throughout the day, which should be considered when identifying trading signals. Don't forget to place a Stop Loss at breakeven if the price moves 15 pips in your favor—this will help protect you from potential losses if the signal turns out to be false.

On Wednesday, preliminary PMIs for April will be published in Germany, the Eurozone, and the U.S. These are fairly interesting data points, but the market is ignoring even more significant macroeconomic indicators. The key issues on the agenda remain the Trump-Powell conflict and the global trade war. The market continues to operate in a state of chaos.

Illustration Explanations:

- Support and Resistance Levels (thick red lines): Thick red lines indicate where movement may come to an end. Please note that these lines are not sources of trading signals.

- Kijun-sen and Senkou Span B Lines: Ichimoku indicator lines transferred from the 4-hour timeframe to the hourly timeframe. These are strong lines.

- Extreme Levels (thin red lines): Thin red lines where the price has previously bounced. These serve as sources of trading signals.

- Yellow Lines: Trendlines, trend channels, or any other technical patterns.

- Indicator 1 on COT Charts: Represents the net position size for each category of traders.