Analysis of Trades and Trading Tips for the Euro

During the second half of the day, the test of 1.0428 coincided with the MACD indicator being significantly below the zero mark, which limited the downside potential of the currency pair. For this reason, I decided against selling the euro at the end of the day.

Yesterday, sellers were quite active in the market. Concerns regarding potential trade tariffs from the Trump administration targeting European countries have created uncertainty in financial markets. Traders are proceeding with caution, favoring the U.S. dollar as a safe-haven asset due to its perceived stability during these uncertain times. Additionally, rumors surrounding possible changes in U.S. trade policy are a significant driver of currency fluctuations. If the Trump administration imposes tariffs, it could adversely affect the export volumes of European countries, increasing the balance of payments deficit and undermining economic confidence.

Today, traders will closely monitor the eurozone's consumer confidence indicator. Recent economic data have not given reasons for optimism. Declining purchasing power and rising inflation are exerting pressure on households, which could harm consumer confidence. In times of uncertainty, economic activity may slow further, adding to the euro's challenges. Additionally, global economic issues, such as shifting trade relations and potential geopolitical risks, could lead market participants to question the stability of the European economy. If the consumer confidence report is weaker than expected, it may reinforce these concerns and strengthen the position of critics who argue that the eurozone faces serious structural problems.

Thus, if the data turns out to be worse than expected, the euro may come under pressure again. Investors should pay attention to how the market will react to these reports and what signals will come from central banks in response to the deteriorating situation.

For today's trades, I plan to focus more on implementing Scenario #1 and Scenario #2.

Buy Signal

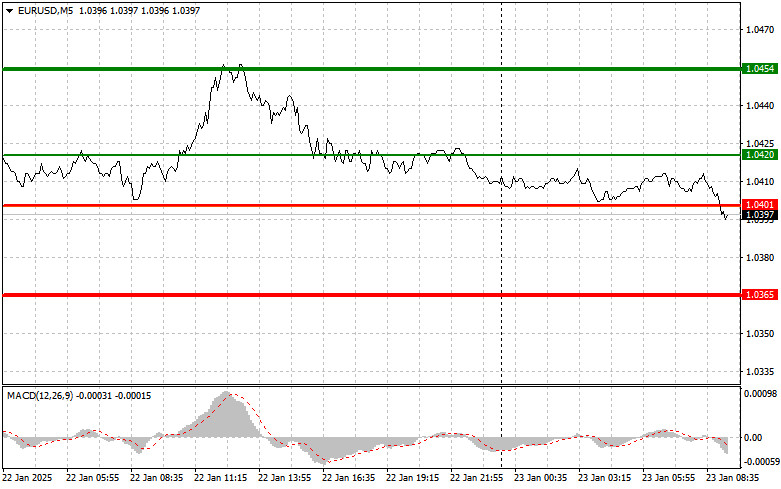

Scenario #1: I plan to buy the euro today if the price reaches 1.0420 (green line on the chart), aiming for a rise to 1.0454. At 1.0454, I will exit the market and sell the euro on a pullback, aiming for a movement of 30-35 pips from the entry point. The euro's growth in the first half of the day depends on exceptionally strong economic data. Important: Before buying, ensure that the MACD indicator is above the zero line and starting to rise.

Scenario #2: Another buying opportunity arises if there are two consecutive tests of 1.0401, with the MACD indicator in the oversold zone. This would limit the pair's downside potential and lead to a market reversal upwards. The targets for this scenario are 1.0420 and 1.0454.

Sell Signal

Scenario #1: I plan to sell the euro after reaching 1.0401 (red line on the chart), targeting 1.0365, where I will exit the market and immediately open a buy position for a rebound of 20-25 pips in the opposite direction. Pressure on the pair could return at any moment. Important: Before selling, ensure that the MACD indicator is below the zero line and starting to decline.

Scenario #2: I also plan to sell the euro today if there are two consecutive tests of 1.0420, with the MACD indicator in the overbought zone. This would limit the pair's upward potential and lead to a market reversal downward. The targets for this scenario are 1.0401 and 1.0365.

Chart Notes

- Thin green line: Entry price for buying the trading instrument.

- Thick green line: A suggested target for Take Profit or manually locking in profits, as further growth above this level is unlikely.

- Thin red line: Entry price for selling the trading instrument.

- Thick red line: A suggested target for Take Profit or manually locking in profits, as further decline below this level is unlikely.

- MACD Indicator: Critical for identifying overbought and oversold zones to guide market entry decisions.

Important Note for Beginner Traders

- Always approach market entry decisions cautiously.

- Avoid trading during major news releases to sidestep volatile price swings.

- If trading during news releases, always set stop-loss orders to minimize losses.

- Trading without stop-loss orders or money management practices can quickly deplete your deposit, especially when using large volumes.

- A clear trading plan, like the one outlined above, is essential for successful trading. Spontaneous trading decisions based on current market conditions are inherently disadvantageous for intraday traders.