The GBP/USD currency pair continued to show signs of growth on Wednesday. It's important to note that this movement is primarily due to the decline of the U.S. dollar rather than an increase in the value of the pound sterling, which is being driven by Donald Trump's tariffs. The impact of these tariffs is significant regardless of who they are imposed upon or what retaliatory measures may follow. As a result, the dollar has been steadily depreciating against both the euro and the pound. For instance, on Tuesday, the dollar weakened following the announcement of increased tariffs on Canada.

Currently, the broader macroeconomic context appears to be of little relevance, as it only triggers localized reactions in the market. The actions and plans of central banks also seem to lack significance; for example, the European Central Bank lowered key interest rates last week, yet the euro barely moved as a result.

The negative factors concerning the British pound that we have discussed over the past year and a half are now largely irrelevant. They will likely remain so as long as Donald Trump continues his tariff policies. We did not expect the market's reaction to these tariffs to be so strong; however, the market has determined how to respond to the dollar's decline. Unfortunately, this depreciation of the U.S. currency has evolved into a significant collapse, which could greatly affect the technical outlook on both daily and weekly timeframes. These timeframes have shown long-standing downward trends, but a sharp increase in GBP/USD could disrupt this and lead to a state of complete uncertainty.

From a macroeconomic and fundamental standpoint, the pound sterling should still be decreasing. However, given the political and geopolitical factors at play, it remains uncertain how long these will dominate the market.

Another reason for the pound's stability is that the UK did not wait for Trump to impose tariffs on its exports; instead, it has begun negotiations with Washington. While the UK was displeased about the global steel and aluminum tariffs, it aims to avoid further restrictions, as noted by Trade Minister Jonathan Reynolds. This approach is certainly sensible. The British economy has seen no growth for 2.5 years and has faced challenges for over a decade, and it does not need additional factors that could hinder its progress. Tariffs, regardless of their specifics, would only impede economic growth, and with the economy already in stagnation, it is close to the brink of recession.

In conclusion, we do not believe that Donald Trump will stop here; more tariffs are likely on the horizon. This suggests that, theoretically, the dollar could continue to decline indefinitely. However, the extent of its drop remains uncertain. We don't know how long the market will focus primarily on this issue or what the next tariffs from Trump will be. It seems even he may not fully comprehend that yet.

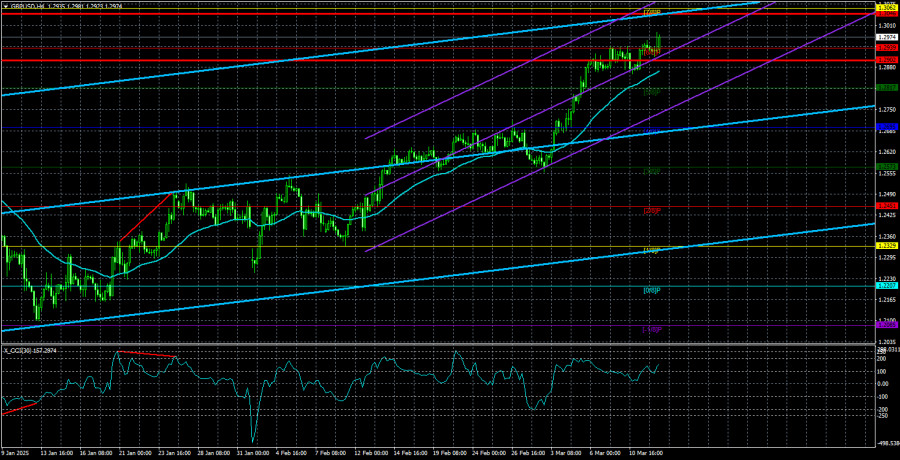

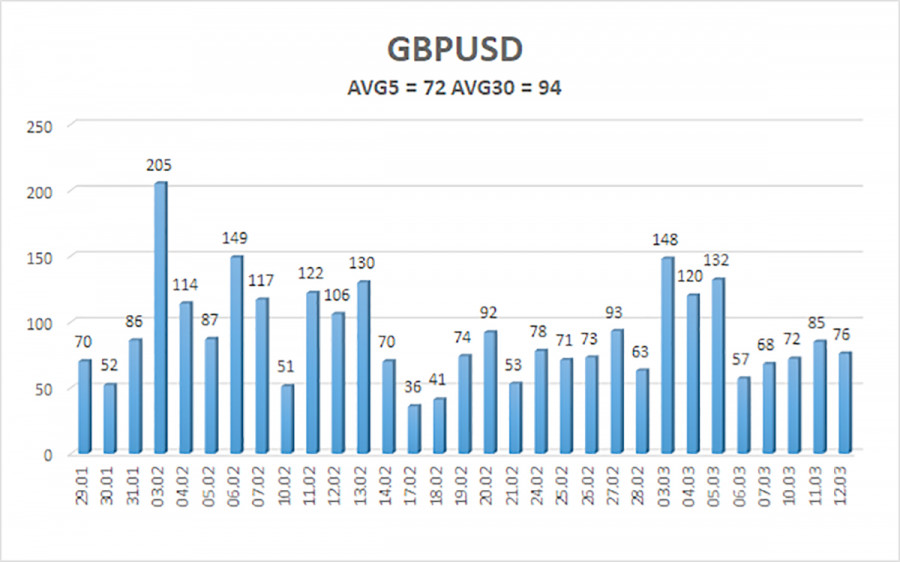

The average volatility of the GBP/USD pair over the last five trading days is 72 pips, which is considered "average" for this pair. On Thursday, March 13, we expect the pair to move within a range limited by 1.2902 and 1.3046. The long-term regression channel has turned upward, but the downtrend remains intact on the daily timeframe. The CCI indicator has recently stayed out of overbought and oversold territory.

Nearest Support Levels:

S1 – 1.2939

S2 – 1.2817

S3 – 1.2695

Nearest Resistance Levels:

R1 – 1.3062

R2 – 1.3184

R3 – 1.3306

Trading Recommendations:

The GBP/USD currency pair maintains a medium-term downtrend. We still do not consider long positions, as we believe the current upward movement is merely a correction that has taken on an illogical, panic-driven surge. If you trade purely on technical analysis, long positions can be considered with targets at 1.3046 and 1.3062 if the price remains above the moving average line. However, sell orders remain far more relevant, with targets at 1.2207 and 1.2146, because eventually, the upward correction on the daily timeframe will end. The pound sterling appears extremely overbought and unjustifiably expensive, yet Donald Trump continues to push the dollar into freefall. How long this dollar collapse will last is extremely difficult to predict.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.