Trade Review and British Pound Trading Tips

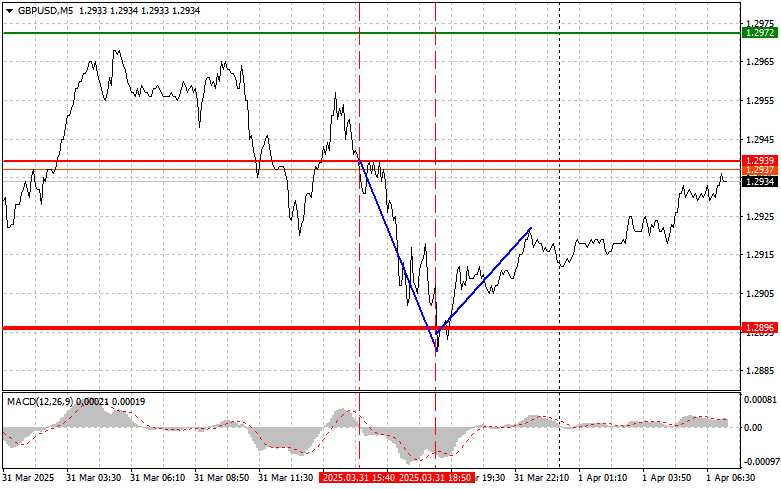

The test of the 1.2939 level occurred just as the MACD indicator began moving down from the zero line, confirming a correct entry point for selling the pound, which resulted in a decline to the target level of 1.2896. A bounce-buy from that level yielded about 20 more points in profit.

Today, important data on the UK Manufacturing PMI for March is expected. In recent months, the British economy has shown signs of slowing, particularly in the manufacturing sector. Although inflation is decreasing, it remains high, putting pressure on consumer spending and business activity. Global economic uncertainty and trade relations are also negatively affecting UK manufacturing orders and investment. If the PMI data comes in below expectations, it will confirm concerns about further economic deterioration. In that case, the Bank of England may be forced to reconsider its monetary policy and possibly continue cutting interest rates. Weak economic data, combined with a potential shift in the BoE's stance, could create conditions for a weakening of the pound.

The speech by Megan Greene may shed light on the current sentiment within the Monetary Policy Committee regarding the future direction of monetary policy. Recently, there has been some uncertainty about the outlook for future policy, so any signals from MPC members will be closely analyzed by the market. Particular attention should be paid to her evaluation of recent economic data, including inflation, employment, and GDP figures.

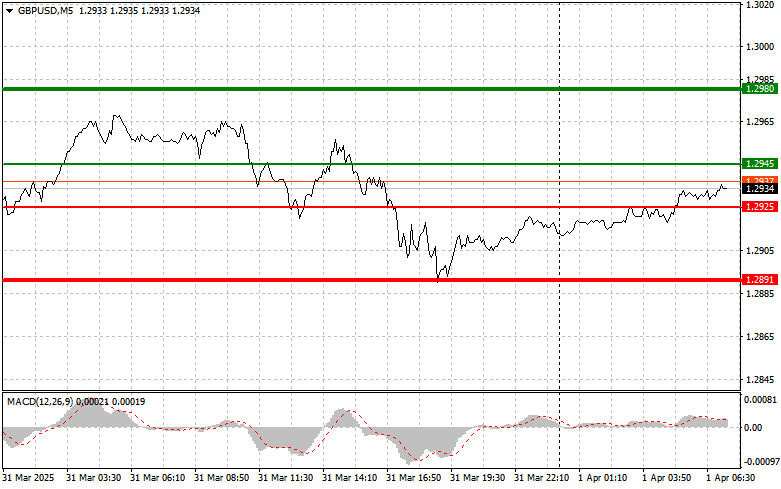

As for the intraday strategy, I'll mainly rely on implementing Scenarios #1 and #2.

Buy Scenarios

Scenario #1: I plan to buy the pound today upon reaching the entry point around 1.2945 (green line on the chart), targeting a rise to 1.2980 (thicker green line on the chart). Around 1.2980, I plan to exit long positions and open short positions in the opposite direction (targeting a 30–35 point pullback). The pound's growth today is only likely after strong economic data. Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to rise.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.2925 level while the MACD indicator is in oversold territory. This will limit the downward potential of the pair and lead to a market reversal upward. Growth to the opposite levels of 1.2945 and 1.2980 can be expected.

Sell Scenarios

Scenario #1: I plan to sell the pound today after breaking below the 1.2925 level (red line on the chart), which will likely trigger a sharp decline in the pair. The main target for sellers will be 1.2891, where I plan to exit short positions and open long positions immediately (targeting a 20–25 point pullback). Selling the pound is better done from higher levels. Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell the pound today in case of two consecutive tests of the 1.2945 level while the MACD is in overbought territory. This will limit the pair's uward potential and lead to a downward market reversal. A drop to the opposite levels of 1.2925 and 1.2891 can be expected.

Chart Key:

- Thin green line – entry price for buying the trading instrument

- Thick green line – projected price for placing Take Profit or manually securing profit, as further growth is unlikely beyond this level

- Thin red line – entry price for selling the trading instrument

- Thick red line – projected price for placing Take Profit or manually securing profit, as further decline is unlikely below this level

- MACD indicator – it is crucial to consider overbought and oversold zones when entering the market

Important: Beginner Forex traders must be very cautious when deciding to enter the market. It's best to stay out before important fundamental reports are released to avoid sharp price swings. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit—especially if you're not using money management and trading large volumes. And remember: to trade successfully, you need a clear trading plan—like the one I've presented above. Making spontaneous trading decisions based on the current market situation is an inherently losing strategy for intraday traders.